Health Care Reform: What Can Employers Do Now?

March 28, 2011

Neither advocates or opponents of the 2010 Health Care Reform bill are satisfied with the provisions of the bill, which attempted to accomplish two major goals—more coverage for more Americans and containment of escalating healthcare costs. Plan renewals effective September 23, 2010 and later include a number of popular provisions that benefit the insured: expanded preventive care, inclusion of children up to age 26 on parents’ policies, elimination of pre-existing conditions for children under 19, removal of lifetime maximum limits, and the phase out of annual maximums. In 2014, the pre-existing condition exclusion will be eliminated for everyone. The challenge is that all these coverage expansions cost money and the success of Health Care Reform is dependent upon full participation by everyone in the country.

The constitutionality of the Patient Protection and Accountable Care Act (ACA), as the Health Care Reform bill is officially named, has already been challenged in four separate federal court cases. While two have been decided in favor the federal government, two have ruled the individual mandate—the requirement that everyone must purchase insurance—unconstitutional. In one case, brought by twenty-seven states, federal judge Roger Vinson ruled that not only was the individual mandate unconstitutional, but in the absence of a severance clause, the entire law must be thrown out. Clearly, we will continue to see negotiation, debate, and challenges to the ACA law.

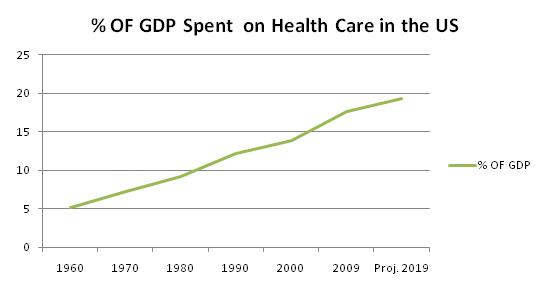

Regardless of one’s opinion on the specifics of the ACA, most of us know that reforming our health care industry is of paramount importance. Our current health care spending is unsustainable and will have increasingly disastrous effects on American lives and businesses. The Department of Health & Human Services has compiled alarming information on health costs as a percentage of Gross Domestic Product:

This steady increase hobbles employers’ ability to invest in other areas and may even threaten their viability. Businesses continually search for ways to manage escalating health care costs and often face difficult choices: sacrifice quality for price when choosing a program; cost-shift to employees through increased deductibles, out-of-pocket expenses, and increased employee premium contributions; or eliminate health care benefits entirely.

Escalating costs can be attributed to a wide range of factors that, taken together, create a perfect storm for health care crisis. On the patient care side, expensive technological advances allow providers to treat or cure complicated diseases. In addition, treatment of chronic conditions such as obesity, diabetes, and heart disease help drive the rampant cost increases. As for the provider side, complicated regulatory and pricing environments, as well as provider shortages, affect health care costs.

Our health care fee-for-service payment model is broken and leaves the consumer in the dark about basic, critical information. Not only do we have difficulty figuring out the cost of our care, but we have few mechanisms for determining quality of care or making informed comparisons before we consume health care services.

When health care fees are paid directly to the provider by the insurance company, patients are disconnected from the financial aspect of health care and are left with skewed perceptions of actual costs. Our out-of-pocket expenses for something fairly simple, such as a respiratory infection, can be minimal—a $25. co-pay for an office visit and $35. co-pay for a generic prescription. We are blissfully oblivious of the actual costs: $250. for the doctor, another $300 for the chest x-ray, and a 10-day supply of antibiotics that costs more than our monthly car payment. Even when consumers try to be informed and vigilant in their efforts to control costs, they encounter terrific difficulties in obtaining the most basic information before treatment. Most often, we only learn the full costs after the fact, when we receive the bill or explanation of benefits from our insurer. A relative of mine recently faced a serious illness and her experience illustrates the typical outcome when a patient tries to be responsibly proactive. When she asked about the cost of a surgical treatment, the doctor’s office staff, clearly surprised by the question, could only tell her that “the doctor charges $3,000 for this procedure.” She received no information about negotiated fees between her doctor and insurer, or her out-of-pocket portion of the fee. After three procedures with this particular surgeon and additional treatment with multiple providers, hospitals, and drugs, my relative’s health care costs exceeded $100,000 that year. Determining the costs in advance is an uphill battle every step of the way and poses a real challenge for people dealing with serious illnesses at the same time.

It is equally difficult to evaluate and make decisions about the quality of the care before we consume it. Health care is much more sensitive and complex than buying a car, where you can research and understand the quality difference between a Mercedes and Kia before making a decision based on price, value, and your particular needs. Even if we know that Dr. A charges $350 and Dr. B charges $2,000, we don’t know which one offers the best value. Are we going to go with the low bidder when our health is at stake? We might. If we had access to information showing historically similar outcomes, we could choose the lower cost provider.

A relevant question at this point is: why would doctors who provide similar services charge such disparate amounts? Doctors face a multitude of pressures regarding their approach to patient care. While one doctor may encourage healthy lifestyle changes, such as weight loss and exercise, before resorting to medications for controllable conditions, another may choose to order more extensive services, including expensive tests and medications, in response to patient demands. Many doctors feel compelled to practice defensive medicine, ordering tests, procedures, and medications in order to lower the chance of being sued; the payoff is that doctors collect more fees and patients think they are being thorough. A doctor’s practice is a business, with overhead, staffing, and profit margin concerns. Business consultants often encourage doctors to install imaging equipment in their offices, which can to be a lucrative income source; doctors naturally discover that more patients could benefit from imaging procedures and more patients, who hear about the in-house technology, ask for and expect it.

It all adds up—defensive medicine, patient demand, increased technology, high overhead, and staffing—to increased medical expenses for the patient. Add to this mix a provider shortage and lack of competition, and it sometimes seems like the sky is the limit when it comes to medical costs.

What can we do as employers to change the system and make it more affordable, efficient, and responsive to our health care needs? There are actually a number of innovative programs and approaches gaining popularity that can help lower health care costs and improve health outcomes. Some large companies are also beginning to create new models of health care for their employees that may prove to be a major component of health care in the future. All of these innovations are grounded on the premise that financial incentives affect our choices, decisions, and behaviors, whether we are individuals, employers, providers, or carriers.

The Consumer Directed Health Plans (CDHP) concept is based on the idea that employees will be savvier consumers of health care if they are aware of and participate in the costs of their health care. CDHP plans feature a large deductible, which is paid out-of-pocket and/or through the employee’s Health Savings Account (HSA) or Health Reimbursement Account (HRA). Variations of these employer funded plans allow the employee to own the money outright or carry it over from year to year.

Wellness and Disease Management programs address the prevention and management of chronic disease, which is one of the major factors driving our health care costs. These programs are based on the concept that spending more money now will result in lower overall costs in the long run.

Wellness programs create incentives and opportunities to stay healthy and prevent chronic conditions associated with unhealthy lifestyles. Unfortunately, we don’t always engage in behaviors that keep us healthy—we eat and drink too much, and exercise and sleep too little. It’s easy to avoid paying attention to our health until we have a problem and must see a doctor. Wellness programs encourage employees to take active steps to improve and maintain their health by providing opportunities and incentives for doing so. An effective wellness program requires a strong commitment on the part of the employer, but data shows that a good wellness program delivers a positive return on investment.

The goal of Disease Management (DM) programs is to mitigate hospitalization costs for people with chronic disease. DM vendors identify patients who may benefit from the program through a review of claim data. Participating patients receive regular monitoring, coaching, and assistance in managing their diseases from nurses who specialize in disease management. This proactive approach can improve the quality of life for patients, as well as reduce overall health care costs.

While nearly every major insurer offers some form of Wellness and Disease Management programs, large self-insured employers are driving the proliferation of these plans. Why? Employers are more invested in the long term health of their employees. While insurers want to keep people healthy, they have less incentive to focus on changes that will yield results for 10, 15, or 20 years down the line. An employer with a steady workforce may have an employee for the entire length of a career and so keeping that employee healthy saves money.

Large employers are creating new, alternative models of health care for their employees. Some have created their own on-site clinics and hired their own medical providers. Employer costs are limited to the clinic rental and staff salaries. Employees have easy access to health care and appointments require less time away from work. Some employers are participating in alternative health care models offered by insurers, including collaborative care and patient centered home programs.

It is important that you, as an employer, actively work to improve health care quality and contain costs. Even if you can’t set up your own clinic or participate in an alternative care model, you can demand more from your providers. Question the care that you and your employees receive. Encourage employees to be proactive in their health care; I am optimistic that most physicians will welcome the opportunity to enlighten patients and talk about treatment plans, including costs. Consider implementing a Wellness Program as a means of mitigating future health care costs, and investigate the benefits of Disease Management coverage.

President Obama is right. Our health care costs have grown to an unsustainable level and they have to be brought under control or our country will suffer. The ACA doesn’t provide the right kind of health care reform to solve the problem, and our current delivery system cannot adapt and innovate unless you demand it. Your business and the future prosperity of America require it.