Keeping Up With Clinical Risk Management:

A Quarterly Publication by Danielle Donovan

A Quarterly Publication by Danielle Donovan

Winter 2019

Keeping Up With Clinical Risk Management:

Who Needs Professional Liability Tail Coverage?

December 17, 2019

A Quarterly Publication by Danielle Donovan

A Quarterly Publication by Danielle DonovanWinter 2019

Tail coverage is a term that may not be part of your daily vocabulary until you are considering something such as moving insurance carriers, or an individual medical provider is questioning retiring or leaving from practice. In order to respond accordingly, you must understand the type of professional liability coverage that your organization purchases. These policies are typically written as occurrence or claims-made coverage.

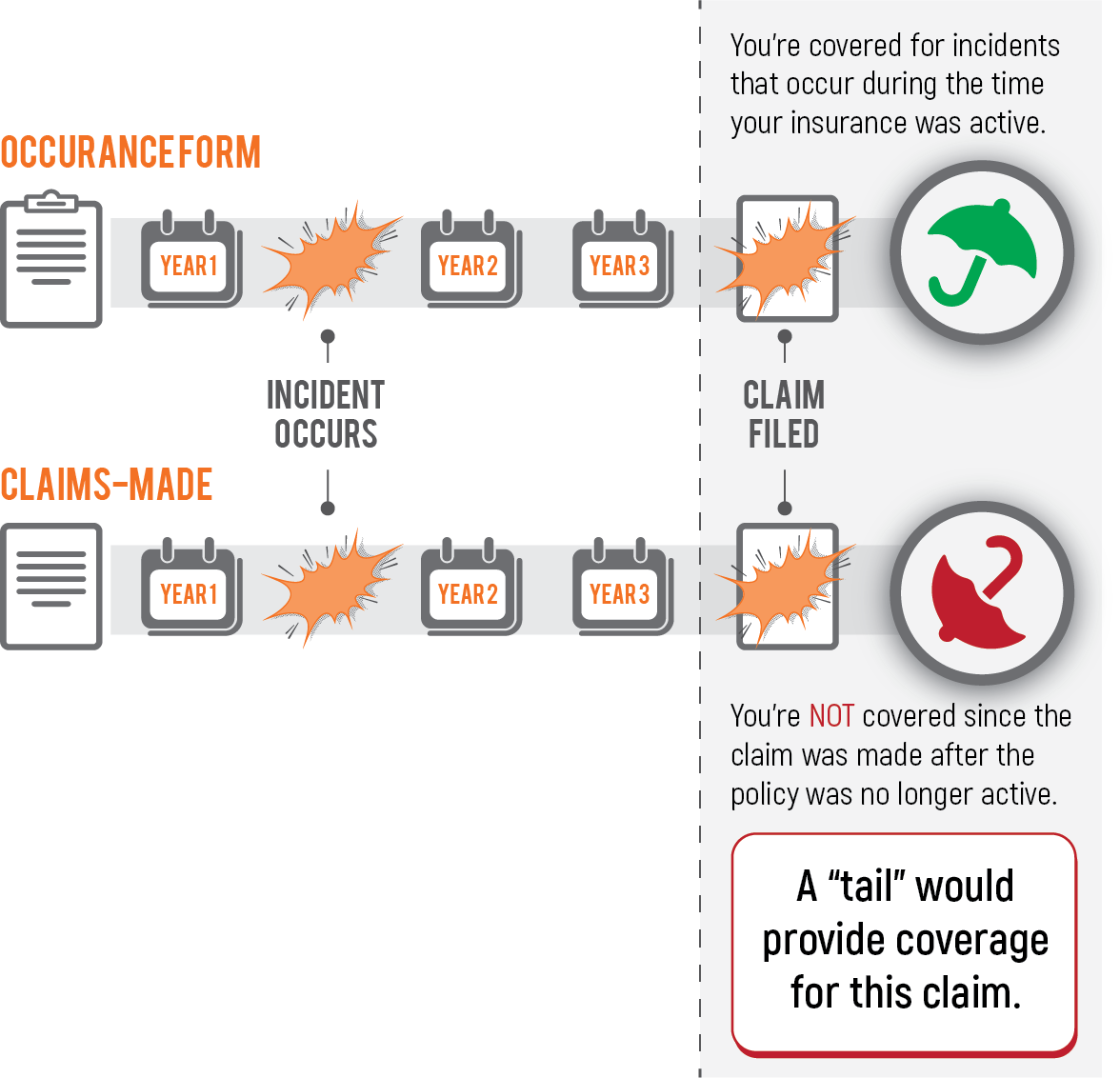

A claims-made policy covers an insured for incidents that occurred after the inception or retroactive coverage date of the policy and is reported to the insurance company while the policy is still in effect. The retroactive date is the date defining the beginning of the coverage period for the claims-made policy. This date should be maintained on all subsequent policies in order to minimize any gaps in coverage.

If an organization is continuing with a claims-made policy, but is considering changing insurance carriers, a new retroactive date may need to be established and an extended reporting period endorsement or “tail coverage” may need to be purchased to avoid any lapse in coverage. Tail coverage, synonymous with an extended reporting period endorsement, permits coverage for claims that are made after the policy period has expired or has been cancelled, provided the incident giving rise to the claim took place during the policy term.

An occurrence policy, which is less common, covers an insured for incidents that occur during a policy period, regardless of when the incident is reported to the carrier or when a claim has been filed. The date that the injury or claim occurred determines the applicable policy period. Unlike a claims-made policy, there is no need for an organization to obtain tail coverage when there may be a decision to change insurance carriers or if a provider departs from your organization.

Whether a provider is employed or contracted may also have an impact on tail endorsement requirements. Typically for an organization that purchases a claims-made policy and employs their medical providers, tail coverage is built into their premium. Therefore, a tail policy would not be required, since claims that occurred while the policy was active and during the provider’s scope of employment would be covered, regardless of when reported. However, for those providers who are contracted and/or considering departing, a tail may not always be included in the claims-made policy premium and will be contingent on the language in the contract and agreement with the insurer.

In order reduce any ambiguity that staff may have about the organization’s insurance structure, consider the following:

- Explore ways to include specifics on insurance coverage in provider contracts. Provide clear language as to whether the policy is claims-made or occurrence and whether separate tail coverage is required.

- Provide information at the time of hire or during the orientation process.

- Conduct ongoing and on-the-spot education when questions arise. Appoint staff members who are familiar with these concepts to be points of contacts for providing education and responding to questions or requests that may arise.

- Partner with your broker to build educational documents that can be given out at the moment of hire, on an ongoing basis, or uploaded on your organization’s intranet page for ease of access.

For more questions on tail coverage and how it relates to your specific program, contact Healthcare Practice Group.

To learn more about claims-made policies, view our vlog Reporting a Claims-made Policy.

Danielle Donovan is Parker, Smith & Feek’s Clinical Risk Manager, dedicated to helping improve our healthcare clients’ operations and mitigate risks. She publishes regular articles to support this effort and provide unbiased advice on issues facing all types of healthcare organizations. Stay tuned for her next installment, and contact Parker, Smith & Feek’s Healthcare Practice Group if you would like to learn more.

Danielle Donovan is Parker, Smith & Feek’s Clinical Risk Manager, dedicated to helping improve our healthcare clients’ operations and mitigate risks. She publishes regular articles to support this effort and provide unbiased advice on issues facing all types of healthcare organizations. Stay tuned for her next installment, and contact Parker, Smith & Feek’s Healthcare Practice Group if you would like to learn more.

Resources and References

- Carroll, Roberta, and Peggy Nakamura. Risk Management Handbook for Healthcare Organizations. Vol. 1, Jossey-Bass A Wiley Imprint, 2011.

- “IRMI: Empowering You to Be the Expert!” Risk Management | Insurance Education | Insurance Information | IRMI.com , https://www.irmi.com/.

The views and opinions expressed within are those of the author(s) and do not necessarily reflect the official policy or position of Parker, Smith & Feek. While every effort has been taken in compiling this information to ensure that its contents are totally accurate, neither the publisher nor the author can accept liability for any inaccuracies or changed circumstances of any information herein or for the consequences of any reliance placed upon it.