Don’t Go Chasing Rabbits… and Other Musings of a Career in Employee Benefits

September 21, 2021

Kevin Norris

Principal, Account Executive

Principal, Account Executive

I was recently asked to write a retrospective article looking back at my 36+ years in this industry and comment on all that has changed. That sent me down a rabbit hole thinking about all that has changed in that time and the many crazy twists and turns along the way. Take technology; when I started out in 1985, we had one PC in an office of a dozen people, and let me tell you, that new IBM PC XT was fast! We would enter census and plan data before leaving for lunch, and it calculated the health insurance rates by the time we returned.

Client interactions were done over the phone, and much was done in person (remember that?). We did not even have fax machines and certainly no email or cell phones. But guess what we did have? Health insurance that cost our employer clients too much and rates that were increasing faster than most other business costs. So, as I ponder the past 36 years, it seems that the more things have changed, the more they have stayed the same.

The Industry’s Evolution

Over the past 36 years, we have tried many strategies to address rising healthcare costs, with varying degrees of success. In that time, we have seen constant increases in costs to both employers and their employees. We have tried PPOs, HMOs, EPOs and ACOs. We have provided employees with FSAs, HRAs and HSAs and encouraged them to live healthier lifestyles with myriad wellness activities and incentives.

Of course, there has been no shortage of government intervention and regulation over this time. There has been OBRA (in several iterations), COBRA (’86), Clinton’s failed Health Security Act (’93), HIPAA (’96), Mental Health Parity (’96), and the biggest of them all, the Patient Protection and Affordable Care Act (’10), to name a few. This most recent piece of historic legislation, and certainly the most impactful over my tenure, required all individuals have health insurance, created new health insurance exchanges along with premium subsidies for people with low and middle incomes, established an employer mandate to provide coverage, expanded Medicaid in many states, and added many other insurance reforms. Since the ACA was enacted, there has been a decrease in the number of uninsured Americans and a rise in the number of people covered by public insurance programs. However, contrary to what the laws name implies, the one thing it did not do was decrease the cost of healthcare.

Speaking of the number of uninsured Americans and the number covered by government programs, both of those numbers have changed considerably during my insurance career. Based upon data from the National Health Interview Survey (NHIS), the percentage of uninsured Americans decreased from 15.0% to 13.9% between 1985 and Q1 2020 (the low point of uninsured people was 10.4% in 2016 and it has crept up since). During this same time, the percentage of Americans who are now insured by government programs, primarily Medicare and Medicaid, has jumped up to 42.8% per the U.S. Census Bureau. The number of people covered by Medicaid alone has increased more than fourfold from 1985 to the first quarter of this year. And yet, some people keep saying that they do not want the government to take over healthcare.

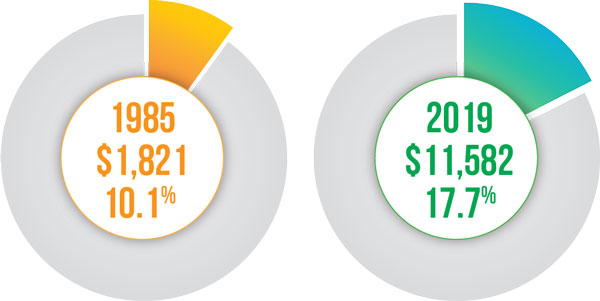

As for what has happened to healthcare costs and spending over the past 36 years, the numbers speak for themselves:

Per capita healthcare spending in unadjusted dollars and as a percentage of GDP:

Looking to the Future

But enough with looking backwards, what are we seeing now and what can we expect to see in the near future?

Currently, the Democrats in Congress are hoping to include the biggest changes to healthcare since the ACA in their budget, targeting major changes in the system with new regulations and increases in federal funding. The items being discussed to include that affect healthcare are:

- Expanding Medicare-covered benefits to include dental, vision, and hearing

- Lowering the Medicare eligibility age

- Closing the Medicaid coverage gap in the states that elected to not expand coverage under the ACA

- Make the expanded exchange subsidies permanent

It will be very interesting to see what they can squeeze into this bill, which represents their single chance in 2021 to pass a reconciliation bill without support from Republicans.

I do expect some trends and changes we have seen over the COVID-19 pandemic to take root and continue to expand and influence our benefit programs, including:

Telehealth Resources:

Most plans now include some form of telehealth and we saw impressive utilization throughout the past year. Per a report from JAMA, in-person medical services declined by 23% last March and 52% last April, while telemedicine visits increased by 1,000% and 4,000% respectively in those months. While that utilization has been decreasing in 2021, it appears that a considerable number of people continue to look to telehealth as a viable way to access certain types of healthcare.

Focus on Mental Health:

COVID-19 may not have created a mental health crisis, but it has forced us to confront one that was already well underway. Today, it is increasingly common to see mental health on lists of top 10 diagnoses ranked by claim spend, and we are more aware of the link between mental and chronic health conditions and the effect on medical costs when untreated. Per the Centers for Disease Control and Prevention, 29% of adults with a medical condition also have some type of mental health disorder, but close to 70% of behavioral health patients have a medical comorbidity. Whereas it seems that the stigma long related to seeking this care is diminishing, we now face the problem of too few mental healthcare practitioners and need for new models of providing care. Mental health is the one area of telehealth utilization that has not declined from last year’s peak utilization, and has continued to increase. Further, insurance carriers are beginning to do a better job of developing alternative ways to access care and identifying providers that specialize in addressing the needs of underrepresented populations.

Federal Transparency Rules

Unrelated to COVID-19, the new federal transparency rules have the potential to transform an industry that has worked hard to keep cost information from the consuming public. “Hospitals and Insurers Didn’t Want You to See These Prices”, a recent article in the New York Times, highlighted the absurdity of a system in which providers charge and insurers pay a huge range of costs for the same services or treatments. We have been talking for years about helping employees be better healthcare consumers, yet it remains nearly impossible to find out how much healthcare actually costs. That may be changing. Effective the first of this year, new rules went into effect requiring that hospitals publish prices for 300 common services. Unfortunately for the consumer, hospital compliance thus far has been limited. A study conducted by Health Affairs found that among the nation’s 100 largest hospitals, 65 were “unambiguously noncompliant.” It seems that the maximum penalty of $109,500 is not much of an incentive when considering the revenue amounts for these hospitals.

Where it gets more interesting is that starting next year, providers and health plans must provide pricing information to consumers, including in-network rates, out-of-network allowed amounts, prescription drug pricing, and an advanced explanation of benefit with a good faith cost estimate. Recent agency guidance has delayed the effective date of these requirements until mid-2022 and 2023, but theoretically we are not far off from being able to truly know what our healthcare costs even before we receive it –isn’t that radical? Now, my question is: will enough people care? This leads me to my last trend…

Financial Wellness and Healthcare Literacy:

These two could be separate subjects, but both represent great challenges that have been magnified during COVID-19 due to misinformation, fear, and confusion, and there are undeniable links between the two. A study by Ramsey Solutions earlier this year revealed that personal finance is the top cause of stress, with 43% of those surveyed saying they worry about finances every day. They went on to say that healthcare costs are a top stressor on people’s finances. It is this writer’s opinion that any investment in these areas of employee education pays off in higher productivity, better employee retention, and reduced healthcare costs.

Parting Thoughts

So, what is with the crazy song lyrics at the top of this article? Well, I always liked that song and anyone who knows me knows I will always defend the music from the ’60s and ‘70s as better than any music since – don’t get me started on that subject. But what brought that song to mind was the idea of the upside-down world Alice faced when she chased that rabbit down its hole and her challenge of getting past many obstacles and making sense of it all. Despite my frustrations at times over the years that our country’s healthcare system was an industry in which logic and proportion had indeed fallen sloppy dead, I do take some solace in knowing that there are many good people striving to create better and more inclusive care and strategies to affect costs, although sustainable cost solutions remain very challenging.

One thing I do know, and which that song from 1967 stressed, is that we need to remember what the dormouse said: feed your head. My interpretation of that lyric (yes, I know there are others) is we all need to feed our heads by continuing to learn and participate in our healthcare system. Like Alice, it may seem at times like we are pawns on someone else’s chessboard, but it is imperative that we keep asking questions, get as much information as possible, and push for new solutions, and only then can we make a difference.

Resources and References

- National Health Interview Survey (NHIS), Centers for Disease Control and Prevention. href=”https://www.cdc.gov/nchs/nhis/index.htm

- United States Census Bureau. https://www.census.gov/data.html

- How has U.S. spending on healthcare changed over time?, Peterson Center on Healthcare and KFF. https://www.healthsystemtracker.org/chartcollection/u-s-spending-healthcare-changed-time/#item-start

- Changes in Health Services Use Among Commercially Insured US Populations During the COVID-19 Pandemic, JAMA Network. https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2772537

- Mental Health and Chronic Disease in the Workplace, Centers for Disease Control and Prevention. https://www.cdc.gov/workplacehealthpromotion/tools-resources/pdfs/NHWP_Mental_Health_and_Chronic_Disease_Combined_3.pdf

- Hospitals and Insurers Didn’t Want You to See These Prices, The New York Times. https://www.nytimes.com/interactive/2021/08/22/upshot/hospital-prices.html

- Low Compliance From Big Hospitals On CMS’s Hospital Price Transparency Rule, Health Affairs. https://www.healthaffairs.org/do/10.1377/hblog20210311.899634/full/

- The State of Personal Finance 2021 Q1, Ramesy Solutions.https://www.ramseysolutions.com/debt/state-of-personal-finance-2021-q1-research

The views and opinions expressed within are those of the author(s) and do not necessarily reflect the official policy or position of Parker, Smith & Feek. While every effort has been taken in compiling this information to ensure that its contents are totally accurate, neither the publisher nor the author can accept liability for any inaccuracies or changed circumstances of any information herein or for the consequences of any reliance placed upon it.