Tips to a Successful Property Renewal

June 28, 2022

Over the past few years, we have experienced the impact of a hard insurance market and watched in disbelief as insurance premiums soared to new heights. While the insurance market remains challenging, there are things you can do to help mitigate rising insurance costs. This begins with understanding how insurers underwrite property risk and the impact your risk management philosophy has on your renewal. The following recommendations will help to improve your risk profile with carriers and reduce your next property renewal.

- Carefully review your building values: How much would it cost to replace your building after a total loss in the current environment? There are resources to help you evaluate the appropriate replacement cost, including:

- Professional appraisals

- General contractors

- Marshall & Swift valuation reports or other valuation tools

Understanding and reporting your assets’ true replacement cost will place you in a more favorable negotiation position with your carrier.

- Highlight capital improvements: Have you replaced a roof or updated electrical, wiring, plumbing, equipment, or HVAC systems? These are important improvements that should be noted and shared with underwriters. They make a difference and can impact your renewal.

- Cultivate a proactive risk management philosophy:

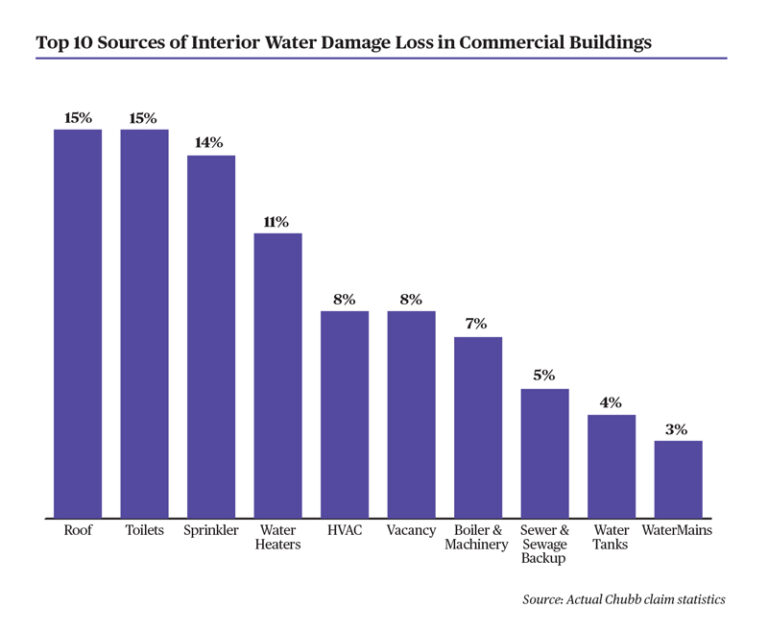

- Develop a water mitigation plan – water damage claims are on the rise and can be costly. According to Chubb’s statistics, the average commercial water damage loss costs $89,000. Therefore, proactively developing and implementing a water mitigation plan can minimize the impact on both your assets and business income following a loss.

- Install water detection sensors, flow sensors, and automatic value shut-off devices –early detection is key to mitigating water damage.

- Sprinkler systems – maintain these in good working order and upgrade as needed.

- Highlight maintenance plan – address any deferred maintenance and outline a plan to tackle big-ticket items.

- Compliance with engineering reports/risk survey recommendations: Review and respond to any engineering or risk survey reports. If there are items that will take time to address, identify and develop a plan to do so. Failing to respond to recommendations can have an adverse effect on your renewal. Housekeeping recommendations are generally the easiest to complete.

- Loss history: As part of the underwriting process, underwriters will review your claims history and develop a loss ratio. The loss ratio is calculated with incurred losses compared to earned premiums and expressed as a percentage. Typically, carriers will review five to ten years of historical data to understand how your portfolio has performed.

- Less than 30% = very good

- 30% to 60% = average

- Greater than 60% = below average

While we all strive for a perfect loss history, things happen. After a loss, it’s important to work with your claims advocate and insurance consultant to develop a narrative based on what led to the incident, lessons learned, and steps you have taken to avoid similar claims in the future.

While this is not an exhaustive list, this will help as you make tough business decisions in the days and months ahead. Don’t forget to bring your insurance advisor into the conversation; we are here to help walk through the insurance implications and advocate on your behalf with your carriers. Reach out to Parker, Smith & Feek’s Real Estate Practice Group to learn more.

Resources and References

- Preventing Water Damage, Chubb.

www.chubb.com/content/dam/chubb-sites/chubb-com/us-en/business-insurance/preventing-water-damage/documents/pdf/water-damage-external-v12.pdf

The views and opinions expressed within are those of the author(s) and do not necessarily reflect the official policy or position of Parker, Smith & Feek. While every effort has been taken in compiling this information to ensure that its contents are totally accurate, neither the publisher nor the author can accept liability for any inaccuracies or changed circumstances of any information herein or for the consequences of any reliance placed upon it.